vanguard tax-exempt bond index fund investor shares

The fund is conservatively managed emphasizing well-diversified highly rated municipal bonds. Decide which type of account.

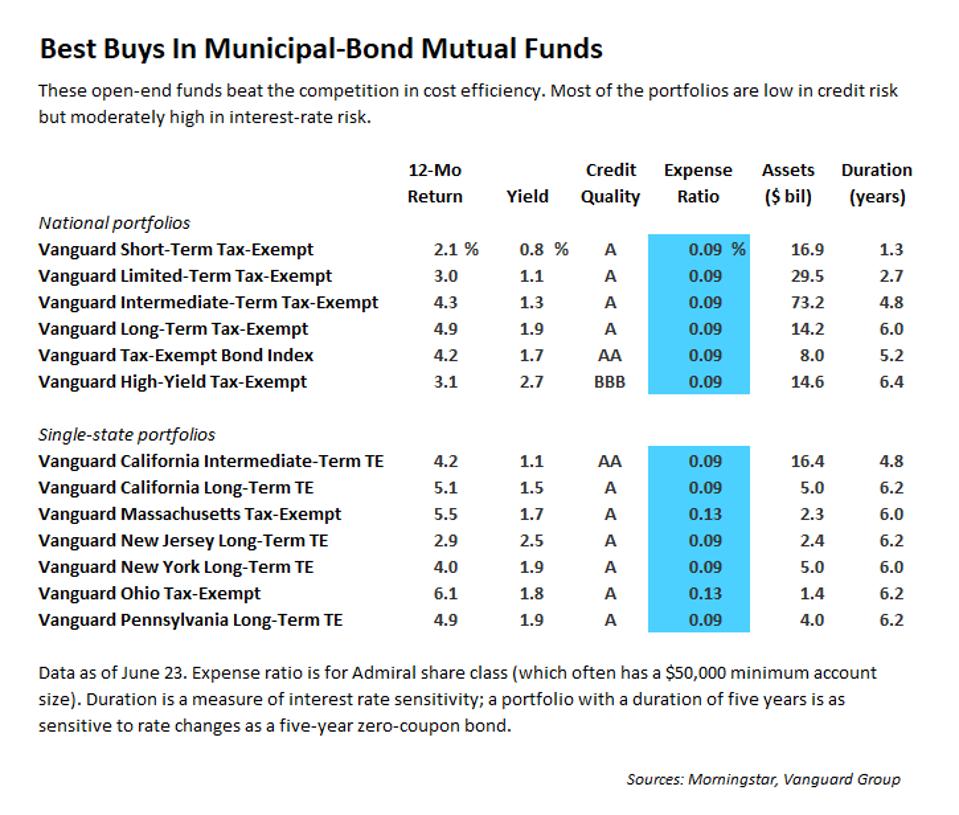

Kiplinger S Pie Chart Investing Chart

Tax-exempt interest dividends from these funds as reported on Form 1099-DIV Box 11 are taxed differently at the federal.

. This mutual fund profile of the Short-Term Tax-Exempt Adm provides details such as the fund objective average annual total returns after-tax returns initial minimum investment expense ratio style and manager information. Buy a Vanguard ETF. Although the income from a municipal bond fund is exempt from federal tax you may owe taxes on any capital gains realized through the funds trading or through your own redemption of shares.

Choose your mutual funds. To see the profile for a specific Vanguard mutual fund ETF or 529 portfolio browse a list of all. Title for data aware layer.

The fund may impose a fee upon sale of your shares or may temporarily suspend your ability to sell shares if the funds liquidity falls below required minimums because of market conditions or other factors. The fund has no limitations on the maturity of. Important tax information for 2021 This tax update provides information to help you report earnings by state from any of your Vanguard municipal bond funds and Vanguard Tax-Managed Balanced Fund on your year-end tax returns.

Choose your Vanguard ETFs. Open an account in 3 steps. You can also learn who should invest in this mutual fund.

The fund is considered nondiversified which means that it may invest a greater percentage of its assets in the securities of particular issuers as compared with diversified mutual funds. Vanguard MassachusettsTax-Exempt Fund Investor Shares Return BeforeTaxes 196 467 400 Return AfterTaxes on Distributions 186 457 392 Return AfterTaxes on Distributions and Sale of Fund Shares 215 423 377 Bloomberg MA Municipal Bond Index reflects no deduction for fees expenses or taxes 094 391 344 Bloomberg Municipal Bond Index. For some investors a portion of the funds income may be subject to state and local taxes as well as to the federal Alternative Minimum Tax.

For more information about. These municipal bonds are generally of intermediate and long maturity. Vanguard core bond fund will offer investor shares with an estimated expense ratio of 025 and.

The funds lower credit quality may. As of November 2021 the fund invested nearly 45 of its assets in bonds issued by municipalities in New York 214 California 145 and Texas 88. For most actively managed funds an investor.

The fund invests in investment-grade municipal bonds from issuers that are primarily state or local governments or agencies whose interest is exempt from US. Enjoy the Vanguard ETF advantage. For the quarter Vanguard Short-Term Tax-Exempt Fund underperformed in benchmark the Bloomberg 1 Year Municipal Bond Index 038 but outperformed its peer-group average 011.

Vanguard mutual funds Vanguard ETFs Vanguard 529 portfolios. The fund is conservatively managed emphasizing well-diversified highly rated municipal bonds. Vanguard - Vanguard Short-Term Tax-Exempt Fund Admiral Shares.

Although the fund seeks to preserve the value of your investment at 100 per share it cannot guarantee it will do so. Knowing this information might save you money on your state tax return as most states dont tax their own municipal bond distributions. For some investors a portion of the funds income may be subject to state and local taxes as well as to the federal Alternative Minimum Tax.

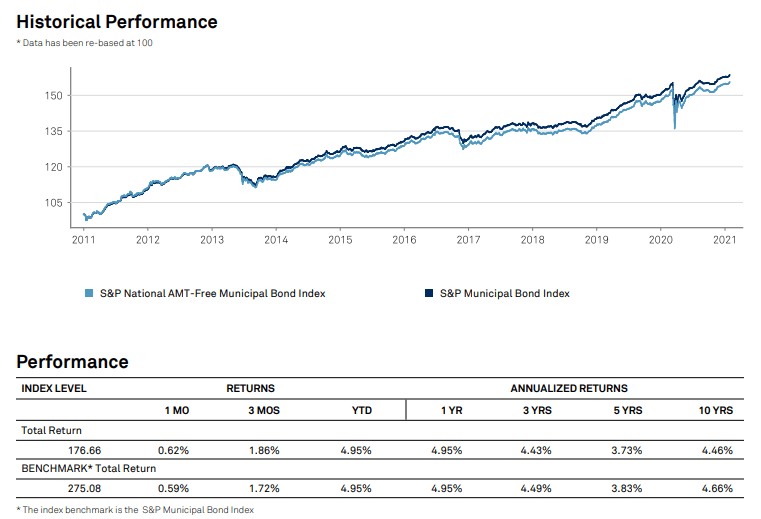

This low-cost municipal bond fund seeks to provide a high level of federally tax-exempt income and typically appeals to investors in higher tax brackets. Although the income from municipal bonds held by a fund is exempt from federal tax you may owe taxes on any capital gains realized through the funds trading or through your own redemption of shares. These municipal bonds are generally of long and intermediate maturity.

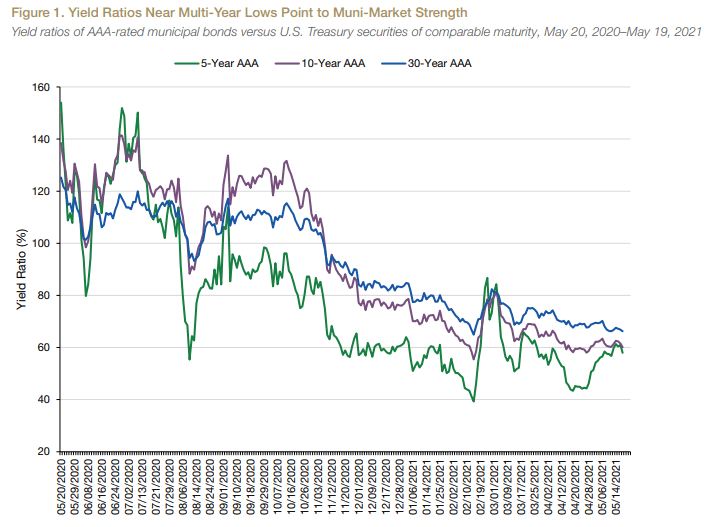

Tax risk which is the chance that all or a portion of the tax-exempt income from municipal bonds held by the fund will be declared taxable possibly with retroactive effect because of. Vanguard Tax-Exempt Bond Index Fund seeks to track the SP National AMT-Free Municipal Bond Index which measures the performance of the investment-grade segment of the US. Utah-specific taxation of municipal bond interest To help you prepare your state income tax return were providing the percentage of federal tax-exempt interest income thats subject to individual income tax in Utah for each Vanguard fund that.

Vanguard Pennsylvania Long-Term Tax-Exempt Fund seeks current income by investing at least 80 of its assets in municipal securities that are exempt from federal and Pennsylvania taxes. Vanguard New Jersey Long-Term Tax-Exempt Fund seeks current income by investing at least 80 of its assets in securities exempt from federal and New Jersey taxes. Admiral or ETF Shares.

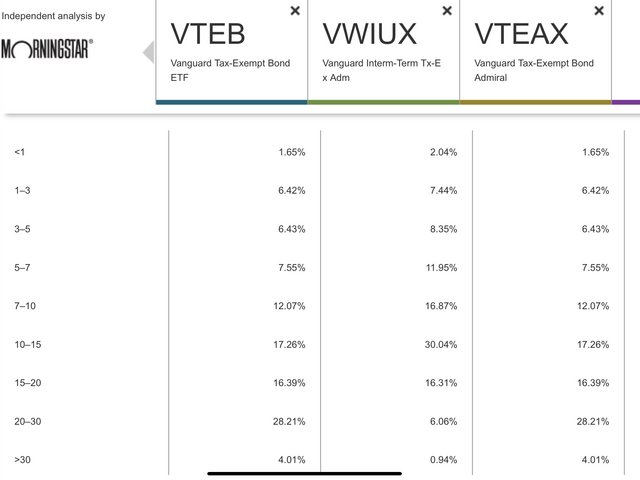

The Investment Seeks A Moderate And Sustainable Level Of Current Income That Is Exempt From Federal Personal Income Taxes. The benchmark holds securities with maturities of 1 to 2 years while the fund holds securities with a broader range of short-term maturities. The fund has no limitations on the maturity of individual securities but is expected to maintain a dollar-weighted average maturity of 10 to 25 years.

Vanguard ETF Shares are not. The indexs sector exclusions steer.

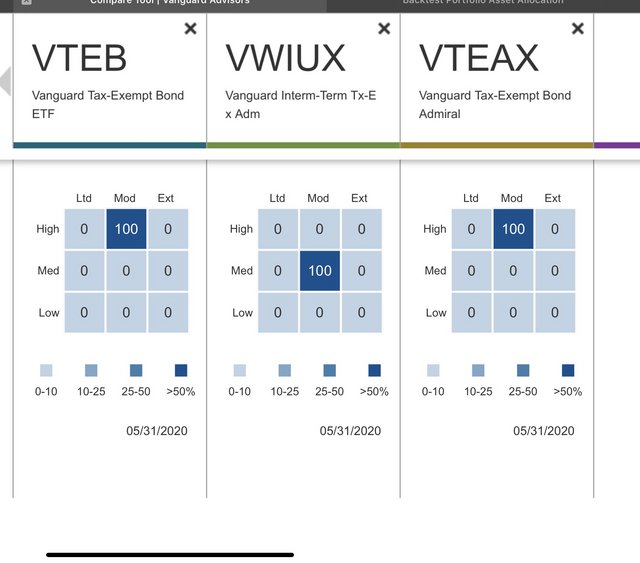

2 Questions About Vanguard S Tax Exempt Bond Index Bogleheads Org

2 Questions About Vanguard S Tax Exempt Bond Index Bogleheads Org

Vnytx Vanguard New York Long Term Tax Exempt Fund Investor Shares Vanguard Advisors

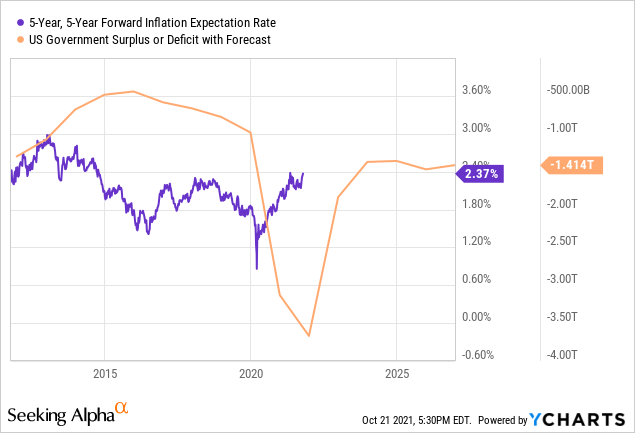

Vanguard Tax Exempt Etf Nysearca Vteb For Investors Wanting Quality Without Leverage Seeking Alpha

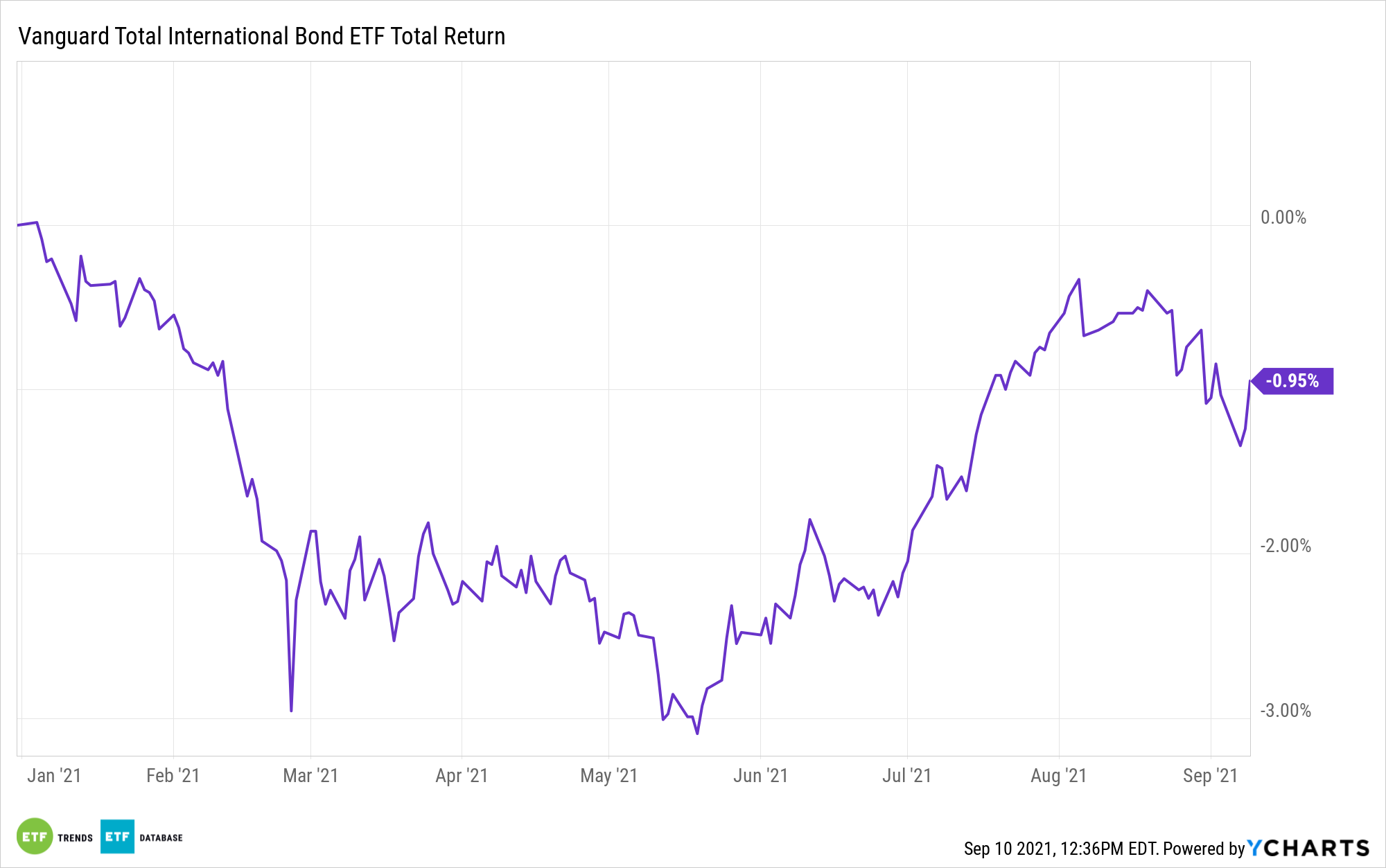

This Pair Of Vanguard Bond Etfs Is All You Need For Globalized Exposure

Vteb Vanguard Tax Exempt Bond Etf Provides 2 Yield With Less Interest Rate Risk Than Many Bond Funds Nysearca Vteb Seeking Alpha

Vanguard Tax Exempt Etf Nysearca Vteb For Investors Wanting Quality Without Leverage Seeking Alpha

Municipal Bond Yields A Renaissance Of Tax Exempt Income

Vanguard Tax Exempt Etf Nysearca Vteb For Investors Wanting Quality Without Leverage Seeking Alpha

What Did U S Fund Investors Do With Their Money In Q1 Morningstar

Vteax Vanguard Tax Exempt Bond Index Fund Admiral Shares Ownership In Us604129q588 State Of Minnesota 13f 13d 13g Filings Fintel Io

Vteb Vanguard Tax Exempt Bond Etf Provides 2 Yield With Less Interest Rate Risk Than Many Bond Funds Nysearca Vteb Seeking Alpha

Vteb Vanguard Tax Exempt Bond Etf Provides 2 Yield With Less Interest Rate Risk Than Many Bond Funds Nysearca Vteb Seeking Alpha

Vteb Vanguard Tax Exempt Bond Index Fund Etf Shares Etf Quote Cnnmoney Com